Lukasz Czekaj, Tomasz Biegus, Robert Kitlowski Szybkie Składki Sp. z o.o., Innowacyjna 1, Suwałki, Poland

Stanisław Raczynski, Mateusz Olszewski, Jakub Dziedzic, Paweł Tomasik, PICTEC, al. Zwyciestwa 96/98, bud. 4, lok. B3.06, Gdynia 81-451, Poland Ryszard Kozera, Alexander Prokopenya

Warsaw University of Life Sciences – SGGW, Nowoursynowska str. 166, 02-787 Warsaw, Poland Robert Olszewski

Warsaw University of Technology, Pl. Politechniki 1, 00-661, Warsaw, Poland

KEYWORDS

Marketing, decision support systems, statistical analysis, optimization, mathematical programming

ABSTRACT

This paper covers automated settlement of receivables in non-governmental organizations. We tackle the problem with entity matching techniques. We consider setup, where base algorithm is used for preliminary ranking of matches, then we apply several novel methods to increase matching quality of base algorithm: score post processing, cascade model and chain model. The methods presented here contribute to automated settlement of receivables, entity matching and multilabel classification in open-world scenario. We evaluate our approach on real world operational data which come from company providing settlement of receivables as a service: proposed methods boost recall from 78% (base model) to > 90% at precision 99%.

INTRODUCTION

Automated settlement of receivables plays an important role in optimisation of the efficiency of finance processes. Incomplete remittance information leads to many hours being spent trying to determine whose payment refer to specific liabilities Beckett (2017). AI solutions may significantly improve payment settlement time PRNewswire (2019), reduce cost and manual effort Poladi (2018).

As the main motivation and playground for testing presented ideas, we used the case of automated settlement of receivables in non-government organizations (NGOs) in the form of sport clubs. However, this problem applies to any situation where many payments have to be assigned to many and unequal number of receivables, which are manually settled by human operators in enterprise resource planning (ERP) systems. The problem requires matching imperfect real-world data (orig-

inating from manual typing to bank transfer details) with proper members/debtors. The above task is further complicated by lack of data structure, misspellings, typos or missing data.

In automated settlement of receivables, for a given moment of time, we have two datasets A (bank transfers) and B (organization members). Rows contains some attributes, e.g. rows in A contains: sender, title, date, amount; rows in B contains: member id, member name, member address, guardian name, duties. Our goal is to

determine for each pair (a, b) ∈ A × B if the transfer

a should be assigned to the organization member b in

order to settle his/her liabilities. Such an assignment is called a match and we denote a set of matches as M and it’s complement as U (the set of unmatched pairs) The matching relationship is many-to-many since one transfer may be used to pay liabilities of several members (e.g. siblings) and there may be multiple payments for one member (e.g. membership fee and sports insurance). However we expect that matching relationship splits into many sparse and small components. We also assume, that the vast majority of transfer matches with at least one member.

Since the set of members may change between time moments (e.g. new members constantly join organization) we cannot directly predict member from transfer attributes: we expect different member set during model development and production. Therefore we tackle the problem in question using entity matching techniques Gu et al. (2003), Gomatam et al. (2002): we calculate similarity score p(a, b) between transfer a and member b, then we use p(a, b) to rank members for given transfer and select members above given threshold as matching. More information about similarity learning may be found in Kaya and Bilge (2019), Abbasnejad et al. (2012).

In classical entity matching, calculation of similarity score splits into two steps. First we transform

a pair (a, b) into features vector (a, b) '→ F (a, b) = [F1(a, b)), . . .], where Fi are some features derived from

attributes of a and b. Features vector express details of similarity: a feature is set true if certain pair of attributes of a and b have similar values/match (in person matching problem feature may reflect if name, date of birth or address matches). In our case we have unstructured data (transfer title which may contain names, description, key words) therefore we have to use more sophisticated features. Functions Fi incorporate also some transformations and standardisation, e.g. replace spelling variations / misspelling of commonly occurring words with standard spelling. In the second step we apply scoring function C to obtain scores from similarity

vector C : F (a, b) '→ p(a, b). Scoring function expresses how informative is the given feature for matching assessment and how different features interact. Scoring function C may be probabilistic model, machine learning model Wilson (2011) or deep learning model Mudgal et al. (2018), Li et al. (2021), Zhao and He (2019) (with end-to-end models that do not have explicit feature vector calculation step).

It was stated above that in automated settlement of receivables we have some extra information about matching structure (e.g., split into many sparse and small

components). As we are strongly focused on very high precision of matching (precision ≥ 99%), we optimise recall for this level of precision. This is motivated by

the observation that it requires much more work to find and fix wrong match than to manually provide missing ones. The above aim makes difference from classical entity matching and here we try to exploit these features. We propose and evaluate different methods of post-processing of similarity scores obtained from matching algorithm: local distance transformation and two stacked models: cascade and chain models.

Proposed methods are inspired by multilabel classification Zhang and Zhou (2014), Gibaja and Ventura (2015) (where it is possible to assign more than one label for the sample, i.e. the sample may belong to more than one class) and open-world classification Xu et al. (2019) (new classes may appear in test/production phase).

Described methods contribute to automated settlement of receivables, entity matching and multilabel classification in open-world scenario.

DATASET

The research was conducted with the aim of solving business problem of a company which provides settlement of receivables as a service. All the experiments were conducted on the dataset supplied by the company. Here we provide dataset characteristics.

Source dataset consists of data from 7 clubs, it contains 33000 transactions, 2300 members and cover the period from 2018−02−05 to 2020−09−10. The source data set was cleaned. We removed duplicates (transactions were multiplied in source dataset when they were matched

with multiple members or receivables), paypall, trans-

actions which were not matched with any members by operator (e.g., direct donations) or there were modifications that made some data useless (e.g., ID has changed over time, missing members, broken relations id date base). After such rectification we obtained about 19000 transactions.

Transactions contain such fields as: sender, title, date of transaction, amount. Sender provides such information as name, surname and address. Title of transaction (string) contains various data (as substrings) since it is manually filled by the sender. We can find there names 71%, surnames 70%, description 68%. Title of transaction may contain some typos (e.g. there may be misspelling in name or some letters may be replaced with their Latin counterpart). Clubs ask payors to place in the title the unique ID of the member. ID has the form AA-BBBB where AA is the club’s ID and BBBB is the numeric ID of member of the club AA. Payors are also asked to send only one transfer for member for a receivable. If these requirements were met, settlement of receivables would be easy. However as we will see this is not the case. We observed that in general only about 65% of transfers contain IDs and there was 4% error rate in the ID format. There are 5% of transfers that are connected with more than 1 member and 13% are connected with more than 1 receivable.

Due to the disproportion in representation of clubs in source data set (the biggest club has 25 times more transactions than the smallest) we have decided to balance dataset and sample at most 500 transaction from each club. In that way we obtained dataset of 3300 transactions. The proportion of transactions with and without ID amounts to 47 : 53

METHODS

In this section we provide description of our base matching algorithm, then we present our methods of increasing matching quality: score post-processing, cascade model and chain model.

Since clubs do not share accounts and receivables, we focus only on transactions and members from single club. For every pair (a, b) of bank transfer and club member we calculate features vector which consists of such features as: member ID in title, name in title/sender, member surname in title/sender, member guardian in title/sender, member/guardian address in sender. Because of declination in Polish language, we check for occurrence of grammatical forms of names and surnames. We also perform soft matching (e.g. matching with respect to Levenshtein distance) to cope with misspellings. We set the label (predicted value) for the pair (a, b) to 1 if it truly matches in the dataset. We use features vector and labels to train XGBoost model Chen and Guestrin (2016). There is big disproportion between the number of positive and negative examples, but it affects only the bias/cutoff in XGBoost model. We do not need to re-balance or re-weight examples.

We evaluate matching quality in precision recall framework since matching is rare event (most of members do not match with given transaction). As it was explained, we focus on maximal recall for precision 95% and 99%. We perform 5-fold validation: 80% of cases go to the train set and the remaining 20% go to the test set.

Our baseline is raw XGBoost score. For a given transfer a we accept as match all members b from the same club as a which obtain score above given threshold.

The first method which we use to increase quality of matching is score post processing. In this method we re-scale the scores in such a way that they sum to 1 b for given transaction a: p(a, b) '→ p(a, b)/ Σ p(a, b).

We accept all the members above new (re-scaled) score.

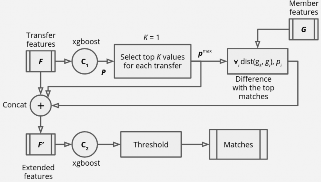

This corresponds with multilabel classification. The intuition behind this method is that we should not look on „absolute” matching score but rather on some „relative” score between the best matching member and other members. If there is no ID in title, for all members we have low scores, however there should be some gap between true matching and rest of pairs. In that case members with scores above the gap would be boosted and we accept the pair (a, b) if this gap is big enough. The second method is the cascade classifier (cf Read et al. (2009)), which consists of two stages, as shown on FIG. 1. Given features vector F (calculated in the same way as in first method), the C1 classifier determines the score p of matching the transfer with a member. Then, for given transfer: the best member is selected (we denote its feature by gk and score by pmax), we compare every member of the club (we denote its features by gi and its score from C1 by pi) with best member; we

obtain dist(gk, gi) = gk ⊕ gi vector of feature which is binary comparison of gk and gi. Finally we build ex-

tended features vector F′ which contains all features from F with added following features: pmax, dist(gk, gi), pi, an integer signifying the position a member had in the ranking step of the previous classification, and the difference between the probability score for the member with higher and the lower position. The extended features vector is then reevaluated using classifier C2 and obtained scores after threshold yields to match between transfer and member.

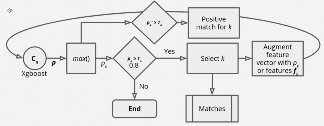

The third method is the chain classifier FIG. 2. It works in iterative manner. It starts with base feature vector F (the same as in previous methods). For given transfer, the best member is selected on the base of scores obtained from classifier C1: if score is above threshold T1, the members is accepted as matching to given transfer. If the best member matched, algorithm moves to the next iteration. In iteration n, best member from previous iteration is excluded from candidate members. The features of the remaining members are extended with the features of the best one from previous iteration. Algorithm uses classifier Cn to obtain new scores. Algorithm finishes when no member gets score above Tn or after 3 iterations. In our experiments we use the same treshold Tn = 0.8.

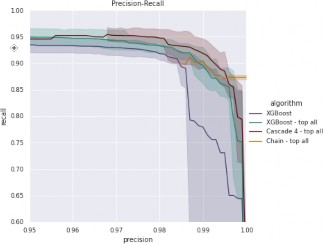

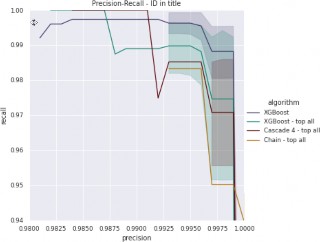

Each of the models was evaluated using 5-fold cross-validation for the best model of each type. Best set of hyperparameters was found using grid search. Mean values of precision-recall curves alongside 95% confidence intervals are presented on FIG. 3. The plot shows performance of the best model of every descried method in the crucial range over 95% precision. „XGboost” is a baseline method. „XGboost – top all” is composition of baseline method with score post processing. „Cascade 4 – top all” and „Chain – top all” are compositions of cascade/chain method with score post processing. We use this composition since they perform better than cascade/chain method alone. As it was argued above, we focus on precision from interval 95% – 100% because it is easier to manually match transfer with member than look for false positive matchings.

To get better insight on the methods performance we provide separate figures for cases which do not contain ID in the title (FIG. 4) and for the cases with ID in title (FIG. 4). Detailed scores for two critical precision thresholds are summarized in TAB. 1.

RESULTS

Baseline method is dominated by the proposed method in mixed case (transfers with and without ID in the title) and no ID in the title case. For the transfers that contain ID in title and extremely high precision (precision > 99%) we observe that baseline model provide the best results. Since detection of ID in the title is quite easy task, we can dispatch models if we need to operate in precision > 99%.

There is large variance in quality of baseline method for hard cases (no ID in title) according to cross-validation split. The reason is that in operating range (precision > 95%) miss-classification of few negative cases leads to significant change of precision and recall. „XGBoost -top all”, „Cascade 4 – top all” and „Chain – top all” behave more stable than baseline methods. „Chain -top all” provide the most stable results.

| Method | all (95%) | all (99%) | with ID(95%) | with ID(99%) | withoutID (95%) | withoutID (99%) |

| XGBoost | 0.934 | 0.779 | NA | 0.997 | 0.71 | 0.49 |

| XGBoost + top all | 0.949 | 0.9 | NA | 0.989 | 0.896 | 0.695 |

| Cascade 4 + top all | 0.945 | 0.918 | NA | 1.0 | 0.906 | 0.834 |

| Chain + top all | NA | 0.905 | NA | NA | NA | 0.816 |

DISCUSSION

We have shown that entity matching framework together with the XGBoost classifier provides efficient machine learning model for automated settlement of receivables. The model operates in a business motivated regime of high precision (>95%). We demonstrated several methods inspired by multi-label classification that increase quality of models in terms of precision-recall curve and cross-validation stability. Proposed methods are modular and may be combined with different base classifiers. We decided on XGBoost together with hand crafted feature because of relatively small dataset. Simpler models (logistic regression and Naive Bayes) was significantly worse.

Early results from the implementation of the presented methods in the company shows reduction of cost to time metric: we observed reduction of time required for settlement of receivables to 25% of the time originally spent on these task. The implementation may also reduce days sales outstanding metric, i.e. average number of days that receivables remain outstanding before they are collected or assigned to club member. Presented methods would be useful in cash flow management in NGOs.

Further experiments may show if additional threshold before score post processing helps: i.e. excluding from matching these transfers where best members has score below threshold. It may play role in case of missing members, e.g. first transfer came before the member was added to system.

Further research is required to determine in which cases the proposed methods help the most (score post-processing does not help if there is ID in title – very confident matching), when it is better to dispatch model and how proposed methods impact on models stability in context of cross validation.

Proposed methods may be also applied in more typical applications of entity matching: entity deduplication, record linkage, object identification.

ACKNOWLEDGMENTS

This research is a part of the project „Development of modern methods of data input and processing, automating the acquisition of funds (. . .) based on artificial intelligence methods.” no. POIR.01.01.01-00-0750/19

REFERENCES

Abbasnejad E.; Ramachandram D.; and Mandava R., 2012. A survey of the state of the art in learning the kernels. Knowledge and Information Systems – KAIS,

31. doi:10.1007/s10115-011-0404-6.

Beckett V., 2017. How treasurers can use AI to simplify invoicing. https://www.theglobaltreasurer.com/2017/09/12/how-treasurers-can-use-ai-to-simplify-invoicing/. Accessed: 2021-06-10.

Chen T. and Guestrin C., 2016. XGBoost: A Scalable Tree Boosting System. In Proceedings of the 22nd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining. ACM, New York, NY, USA, KDD ’16. ISBN 978-1-4503-4232-2, 785–794. doi:10.1145/2939672.2939785. URL http://doi.acm.org/10.1145/2939672.2939785.

Gibaja E. and Ventura S., 2015. A Tutorial on Multi-Label Learning. ACM Computing Surveys, 47. doi: 10.1145/2716262.

Gomatam S.; Carter R.; Ariet M.; and Mitchell G., 2002. An Empirical Comparison of Record Linkage Procedures. Statistics in medicine, 21, 1485–96. doi: 10.1002/sim.1147.

Gu L.; Baxter R.; Vickers D.; and Rainsford C., 2003. Record Linkage: Current Practice and Future Directions. CSIRO Mathematical and Information Sciences Technical Report, 3.

Kaya M. and Bilge H., 2019. Deep Metric Learning: A Survey. Symmetry, 11, 1066. doi:10.3390/ sym11091066.

Li Y.; Li J.; Suhara Y.; Wang J.; Hirota W.; and Tan W., 2021. Deep Entity Matching. Journal of Data and Information Quality (JDIQ), 13, 1 – 17.

Mudgal S.; Li H.; Rekatsinas T.; Doan A.; Park Y.; Krishnan G.; Deep R.; Arcaute E.; and Raghavendra V., 2018. Deep Learning for Entity Matching: A Design Space Exploration. In Proceedings of the 2018 International Conference on Management of Data. Association for Computing Machinery, New York, NY, USA, SIGMOD ’18. ISBN 9781450347037, 19–34. doi: 10.1145/3183713.3196926. URL https://doi.org/10.1145/3183713.3196926.

Poladi R., 2018. Automating Cash Application With Artificial Intelligence. https://www.eurofinance.com/wp-content/uploads/ D1-15.40-2-Ranjith-Poladi.pdf. Accessed: 2021-06-10.

PRNewswire, 2019. Flywire Adds Machine Learning Capabilities to its Payment Platform. https://martechseries.com/mobile/mobile-marketing/ flywire-adds-machine-learning-capabilities-to-its-payment-platform/. Accessed: 2021-06-10.

Read J.; Pfahringer B.; Holmes G.; and Frank E., 2009. Classifier Chains for Multi-label Classification. In Machine Learning. vol. 85. ISBN 978-3-642-04173-0, 254–269. doi:10.1007/978-3-642-04174-7_17.

Wilson D.R., 2011. Beyond probabilistic record linkage: Using neural networks and complex features to improve genealogical record linkage. In The 2011 International Joint Conference on Neural Networks. 9–14. doi:10.1109/IJCNN.2011.6033192.

Xu H.; Liu B.; Shu L.; and Yu P., 2019. Open-World Learning and Application to Product Classification. In The World Wide Web Conference. Association for Computing Machinery, New York, NY, USA, WWW ’19. ISBN 9781450366748, 3413–3419. doi: 10.1145/3308558.3313644. URL https://doi.org/10.1145/3308558.3313644.

Zhang M.L. and Zhou Z.H., 2014. A Review on Multi-Label Learning Algorithms. IEEE Transactions on Knowledge and Data Engineering, 26, no. 8, 1819–1837. doi:10.1109/TKDE.2013.39.

Zhao C. and He Y., 2019. Auto-EM: End-to-end Fuzzy Entity-Matching using Pre-trained Deep Models and Transfer Learning. The World Wide Web Conference.